Exness Leverage: Unlocking Trading Opportunities

In the world of trading, leverage is a powerful tool that can significantly enhance your trading capabilities. Exness Leverage Exness leverage allows traders to control larger positions with a relatively small amount of capital. This article aims to delve deeper into the concept of leverage, specifically in the context of Exness, highlighting its benefits, risks, and strategic applications.

What is Leverage?

Leverage in trading is a technique that enables traders to amplify their exposure to a financial market without having to commit the full amount of capital required to open a position. Essentially, it allows you to borrow funds from your broker to increase your investment size, potentially leading to higher returns. For example, if a trader uses 1:100 leverage, they can control a position worth $100,000 with only $1,000 of their own capital.

Understanding Exness Leverage

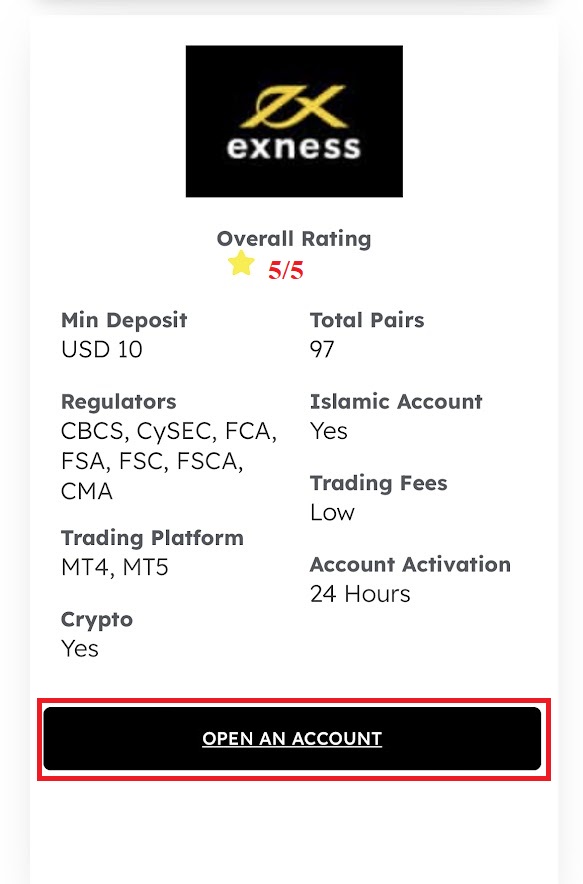

Exness, an online forex broker, offers a range of leverage options to suit different trading strategies and risk appetites. Traders can choose leverage ratios that can go as high as 1:2000, depending on the account type and trading instruments. This powerful leverage potential can lead to substantial profits, but it also comes with increased risk. Therefore, understanding how to use it effectively is crucial for any trader.

Benefits of Using Leverage with Exness

1. Increased Potential for Profit

The primary advantage of utilizing leverage is the increased potential for profit. By controlling larger positions, traders can magnify their profits from small price movements in the market. This can be especially beneficial in the forex market, where even minor fluctuations can lead to significant gains when using leverage.

2. Cost Efficiency

Leverage allows traders to maintain a diversified portfolio without needing to invest large amounts of capital. This means you can open multiple positions across various instruments without tying up all your funds, which can be crucial for effective risk management and strategy diversification.

3. Access to Advanced Trading Strategies

With leverage, traders can engage in more advanced trading strategies, such as hedging, scalping, or swing trading. These strategies often require a more substantial capital base to be executed effectively, and leverage provides the means to access these strategies even with limited funds.

Risks Associated with Leverage

1. Increased Risk of Loss

While leverage can lead to increased profits, it also amplifies losses. If the market moves against your position, the losses can exceed your initial investment, leading to significant financial risk. This is why it’s vital to have a clear risk management strategy when trading with leverage.

2. Margin Calls

Utilizing high levels of leverage increases the likelihood of experiencing a margin call. This occurs when the equity in your trading account falls below the required margin level, prompting the broker to either close your positions or require you to deposit additional funds to maintain your open trades.

3. Emotional Pressure

The potential for high profits can lead to emotional decision-making. Traders may feel more pressured to make quick decisions, which can result in impulsive trading behavior and increased chances of losses. Maintaining discipline and a well-thought-out trading plan is essential when trading with leverage.

How to Use Exness Leverage Effectively

To maximize the benefits of Exness leverage while minimizing risks, traders should consider the following strategies:

1. Develop a Robust Trading Plan

A well-structured trading plan is essential to successful trading, particularly when leverage is involved. This plan should outline your risk tolerance, profit targets, and entry and exit strategies. By sticking to this plan, you can avoid emotional decision-making and enhance your trading discipline.

2. Implement Risk Management Techniques

Effective risk management strategies are critical when using leverage. Consider using stop-loss orders to protect your capital and limit potential losses. Additionally, determine the appropriate position size based on your overall account balance and the level of leverage you are comfortable with. A common rule of thumb is to risk no more than 1% of your trading account on any single trade.

3. Stay Informed About Market Conditions

Staying updated on market news and economic indicators can help you make informed trading decisions. Understanding the factors that influence currency movements can be instrumental in predicting market trends, allowing you to adjust your strategy as needed.

Conclusion

Exness leverage is a powerful tool that, when used strategically, can enhance your trading experience and profitability. However, it is crucial to be mindful of the risks involved and implement effective risk management practices. By developing a solid trading plan and staying informed about the market, traders can leverage the benefits of Exness to maximize their trading potential while minimizing potential downsides.

In summary, leverage is an integral part of trading with Exness, and understanding how to navigate its complexities is essential for any trader seeking success in the forex market.